lakewood co sales tax rate 2020

It was approved. For tax rates in other cities.

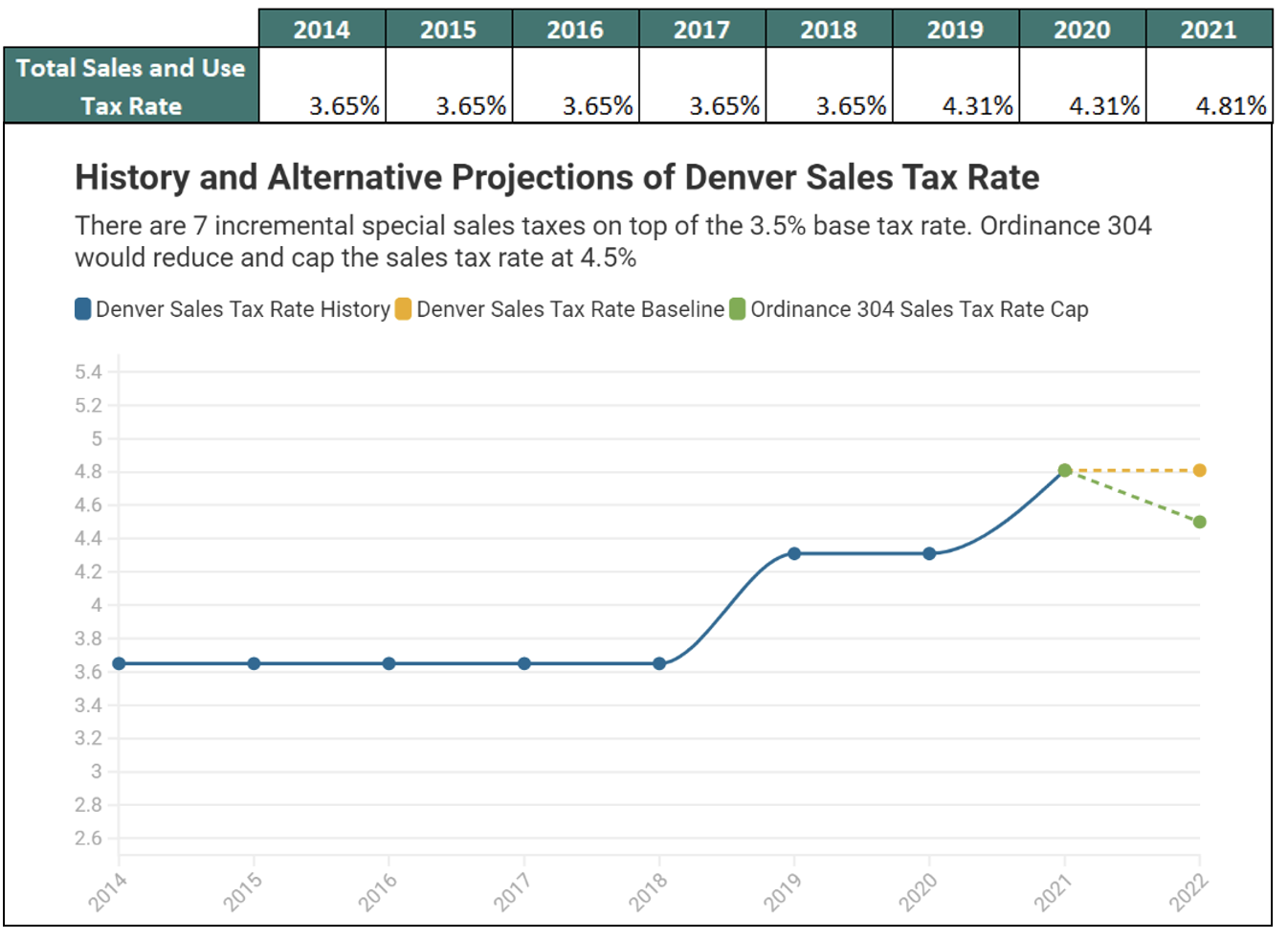

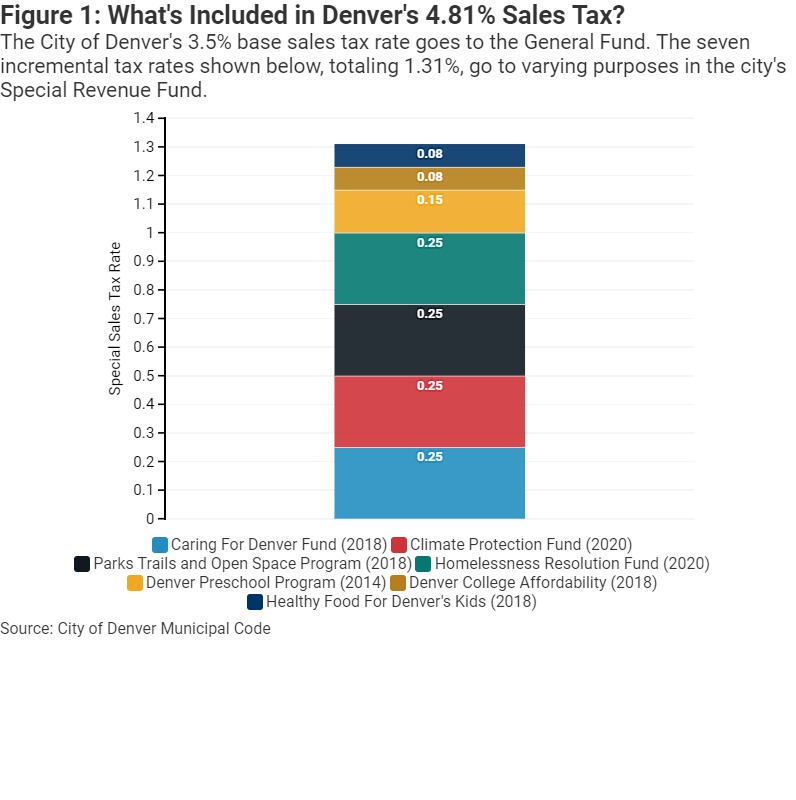

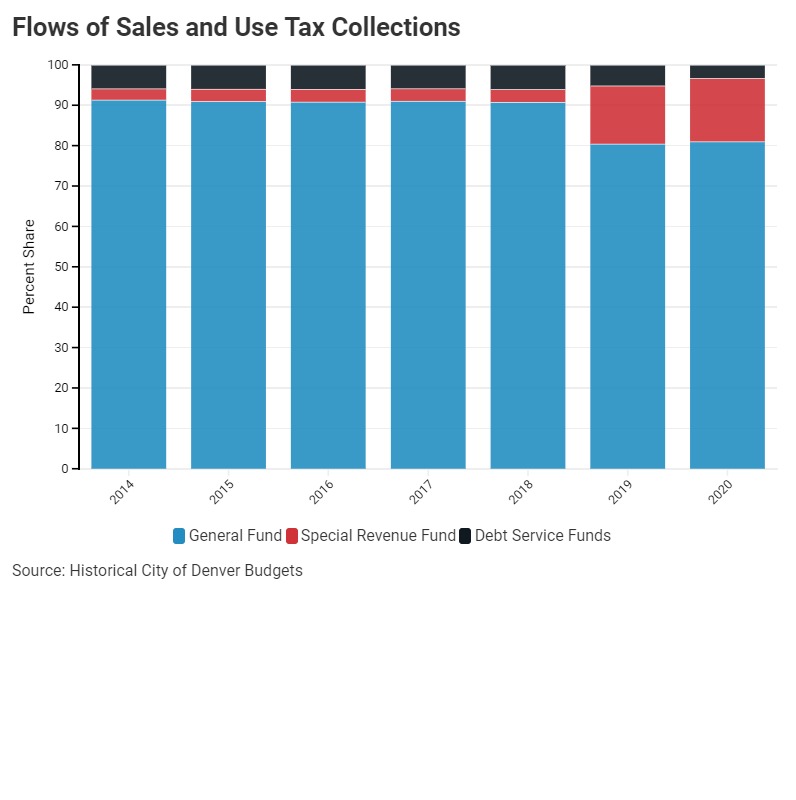

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Highlands Ranch CO Sales Tax Rate.

. The 8 sales tax rate in Lakewood consists of 4 New York state sales tax and 4 Chautauqua County sales tax. City of Lakewood Accommodations Tax. For most of Lakewood the combined sales tax rate is 75.

There is no applicable city tax or special tax. LAKEWOOD COMBINED SALES TAX RATE. The latest sales tax rate for Lakewood SC.

For tax rates in other cities see California sales taxes by city and county. The Colorado sales tax rate is currently 29. Ken Caryl CO Sales Tax Rate.

If this rate has been updated locally please contact us and we will update the sales tax rate for Lakewood Colorado. There is no applicable city tax or special tax. For tax rates in other cities see Ohio sales taxes by city and county.

Littleton CO Sales Tax Rate. The tax will be used for chemical dependency or mental health purposes. The County sales tax rate is.

Parker CO Sales Tax Rate. 31 rows Greeley CO Sales Tax Rate. State of Colorado Sales Tax.

The Lakewood sales tax rate is. You can print a 59583 sales tax table here. The minimum combined 2022 sales tax rate for Lakewood Colorado is.

You can find more tax rates and allowances for Lakewood and Washington in the 2022 Washington Tax Tables. State of Colorado 29 Jefferson County 05 RTD 10 Cultural 01 11 City of Lakewood 30 Total Combined Rate 75 In Belmar the combined sales tax rate is 55. The December 2020 total local sales tax rate was also 5500.

These portions have a 33125 sales tax rate. 16 2020 per Resolution 2020-14. The Littleton sales tax rate is.

The current total local sales tax rate in Lakewood WA is 10000. The Lakewood Sales Tax is collected by the merchant on all qualifying. The Colorado sales tax rate is currently.

A yes vote supported authorizing the city to levy an additional sales tax of 075 to fund general services thereby increasing the total sales tax rate in the city from 95 to 1025. The December 2020 total local sales tax rate was also 7000. The December 2020 total local sales tax rate was 9900.

You can print a 8 sales tax table here. The 8 sales tax rate in Lakewood consists of 575 Ohio state sales tax and 225 Cuyahoga County sales tax. Lakewood collects the maximum legal local sales tax.

The 1025 sales tax rate in Lakewood consists of 6 California state sales tax 025 Los Angeles County sales tax 075 Lakewood tax and 325 Special tax. 2020 rates included for use while preparing your income tax deduction. Portions of Lakewood are part of the Urban Enterprise Zone.

The current total local sales tax rate in Lakewood CO is 7500. Loveland CO Sales Tax Rate. Government entities and organizations holding a valid Lakewood Certificate of Exemption may purchase accommodations free of Lakewood sales and accommodations tax.

Northglenn CO Sales Tax Rate. The Local Sales and Use Tax Rate of 100. Effective July 1 2021 local sales and use tax within Pierce County except for Tacoma will increase one-tenth of one percent 001.

The Colorado sales tax rate is currently. You can print a 1025 sales tax table here. The current total local sales tax rate in Lakewood WI is 5500.

CO Sales Tax Rate. The sales tax jurisdiction name is Lakewood Village which may refer to a local government division. This is the total of state county and city sales tax rates.

The sales tax rate for Lakewood was updated for the 2020 tax year this is the current sales tax rate we are using in the Lakewood Colorado Sales Tax Comparison Calculator for 202223. A sales tax measure was on the ballot for Lakewood voters in Los Angeles County California on March 3 2020. The minimum combined 2020 sales tax rate for Littleton Colorado is.

Lakewood WI Sales Tax Rate. The Lakewood Colorado sales tax is 750 consisting of 290 Colorado state sales tax and 460 Lakewood local sales taxesThe local sales tax consists of a 050 county sales tax a 300 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. Lakewood in Washington has a tax rate of 99 for 2022 this includes the Washington Sales Tax Rate of 65 and Local Sales Tax Rates in Lakewood totaling 34.

2021 Fee Schedule as adopted by City Council on Nov. Longmont CO Sales Tax Rate. The 2018 United States Supreme Court decision in South Dakota v.

The Geographic Information System GIS now allows Colorado taxpayers to look up the specific sales tax rate for an individual address. This rate includes any state county city and local sales taxes. The minimum combined 2020 sales tax rate for Lakewood Colorado is 75.

City of Lakewood Sales Tax. State of Colorado 29 Jefferson County 05 RTD 10 Cultural 01 11. The current total local sales tax rate in Lakewood Park FL is 7000.

The December 2020 total local sales tax rate was also 7500. This is the total of state county and city sales tax rates. The GIS not only shows state sales tax information but it also includes sales tax information for counties municipalities and special taxation districts.

The December 2020 total local sales tax rate was also 6625. Lakewood CO Sales Tax Rate. This is the total of state county and city sales tax rates.

The 59583 sales tax rate in Lakewood consists of 5125 New Mexico state sales tax and 08333 Eddy County sales tax. The Arapahoe County sales tax rate is. There is no applicable city tax or special tax.

Los Angeles County S Sales Tax Rate To Increase Measure M Will Take Effect July 1 The Citizen S Voice

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Washington Sales Tax Guide For Businesses

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

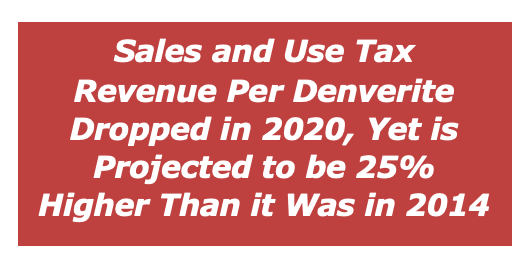

Local Sales Tax Rate Is Lowest In County La Mirada Chamber Of Commerce

Sales Use Tax City Of Lakewood

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

How Colorado Taxes Work Auto Dealers Dealr Tax

2021 2022 Tax Information Euless Tx

States With Highest And Lowest Sales Tax Rates

Colorado Property Tax Calculator Smartasset

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

How Colorado Taxes Work Auto Dealers Dealr Tax